Download Sodhanis Indirect Tax Summary for CA Final Nov. 18 (Old & New Scheme) - CA Vineet Sodhani | PDF

Related searches:

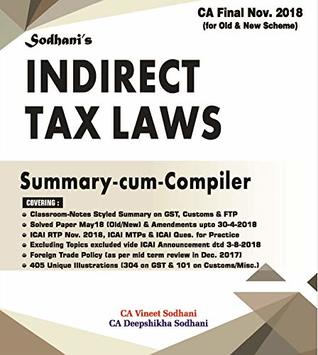

Sodhani's Indirect Tax Laws Summary cum Compiler [IDT] for CA

Sodhanis Indirect Tax Summary for CA Final Nov. 18 (Old & New Scheme)

Buy Sodhanis Indirect Tax Summary Compiler for CA Final Nov

Buy Sodhanis Indirect Tax Laws for CA Final May2021 Book

GST Summary Notes (Updated for Jan/Feb 2021 Exams) - CA Blog

Summary Book Of Indirect Tax Laws, GST & Custom for CA, CS

How to Prepare for Taxation - Direct & Indirect Tax : CA

CA Final Direct Tax (DT) Summary for May 2020 Exams

CA Final COMBO Direct & Indirect Tax (REGULAR BATCH) For May

Buy CA final IDT INDIRECT TAX LAW AND PRACTICE COMPILER for

Free Download Indirect Tax Book For Ca Final Bangar

Buy IDT Bangar for CA Final indirect tax law For May 2021 BY

Indirect tax laws� part-1good and services tax, part-2 customs law with ftf by ca uttam prakash agarwal and ca mahesh gour ₹1,050 ₹950 ca final gst summary book for may 2020 by ca manoj batra.

Everywhere and every time, the president stresses that if a student wants to clear ca final, the only sure shot reliable source is the icai material. But, we, ca finalist will prefer to give 2-3 attempts rather than study the icai materials. We will spend 20k and will do anything but we will never trust icai materials.

Ca final may 2021 sodhani's indirect tax laws summary-cum-compiler 28 th edition (since 2007 ) ca vineet sodhani ca deepshikha sodhani free call 07314074750� 9827037713 cart.

Pwc world wide tax summaries, wwts helps external client users to get up-to-date summary of basic information about corporate tax and individual taxes in over 150 countries worldwide.

1 review for ca final indirect tax laws summary book by ca yashvant mangal.

Ca final / by studyfromnotes this is certified copy indirect tax (gst and customs) of air 33 of nov 2020 attempt of ca final.

Cs executive indirect tax summary notes applicable for 2019 exams and onward. Gst does away with the cascading effects of taxation, by providing a comprehensive and continuous chain of tax credits, end to end and taxing only the value-add at every stage.

Ca foundation videos (new syllabus) principles and practices of accounting; business laws and business correspondence and reporting; business mathematics and logical.

Ca final indirect tax- gst 30 day batch for may mcq download� download free books scroll down and download ca final idtl summary of place idt indirect tax laws yogendra bangar books ca books yogendra bangar. Page 1� know more about ca final indirect tax laws download free books.

Ca final ca final indirect tax idt paper 2021 study material 2021 for new revised course. This is very helpful for the ca final students in that they can download the entire syllabus of the ca finals dt paper 2021 for free from icai (institute of chartered accountants of india).

S federal, state, county and local governments impose taxes and fees on a variety of businesses, goods and services for many reasons. A large number of them are indirect taxes that are imposed on interim products or factors of production.

Smarttrust® tax free income 30 f ca- performance charts including intraday, historical charts and prices and keydata.

Smarttrust® tax free income 30 ca- performance charts including intraday, historical charts and prices and keydata.

Vdi indirect tax laws summary cum compiler for ca final old and new syllabus by vineet sodhani deepshikha sodhani for may 2021 exam special price ₹425.

Students, ca final new course, tips and tricks to prepare ca final indirect tax laws idt ca final in 2 months +91-90708 00090� sign in/up +91-90708 00090,.

Sodhani's indirect tax laws summary-cum-compiler by vineet sodhani and deepshikha sodhani for nov 2020 exam.

Indirect tax is not only a tax to the financial services (fs) industry, but a true cost. In our philosophy; getting in control of your indirect tax position goes hand-in-hand with managing and optimizing your cost-base. More than 150 countries have implemented some sort of indirect tax system.

Practice manual is your go-to-resource – indirect taxes are easier to cover, and reading through the practice manual is the best way to prepare for taxation in the ca intermediate exam. Step 4: pay attention to peripheral topics as well – topics like residential status, provisions related to filing returns, tds, advance tax, etc are quite.

The united states (us) does not have a national sales-tax system. Each state has the authority to impose its own sales and use tax, subject to us constitutional restrictions.

In you will get everything that you need to be successful in your ca cs cma exam – india’s best faculty video classes (online or in pen drive) most popular books of best authors (ebooks hard copies) best scanners and all exam related information and notifications.

Ca final indirect tax laws summary book by ca yashwant mangal. Special features of our summary book� updated with all amendments upto 30th april 2020. Includes tables, flow chart and diagrams for easy understandability.

Summary final exam india, 5 days ago ca final indirect tax laws summary by vineet sodhani and deepshikha sodhani,ca final indirect tax laws.

Ca-ipc-testm17-sodhanis-schedule-features - read online for free. O scribd é o maior site social de leitura e publicação do mundo.

The reform that took more than a decade of mutual co-operation, continuous discussion and intense debate between central and state governments about implementation methodology, was finally implemented with effect from 1st july 2017, subsuming almost all indirect taxes at the central and state.

Here's a crash course on everything you need to know when it comes to taxes. From tax refunds to irs secrets to tax scandals, we're giving out all the information you need to know, completely tax-free of course.

Calculate how much you can expect to pay in property taxes on your home in orange county, california. Orange county is the one of the most densely populated counties in the state of calif.

State-by-state guide to taxes on middle-class families click on any state in the map below for a detailed summary of state taxes on income, property, and items you buy on a daily basis.

Gst summary notes applicable for jan/feb 2021 exams ⇒ gst quick revision capsule by icai ⇒ gst brief notes ⇒ gst revision book ⇒ gst book by yogesh verma ⇒ gst book by rahul garg. Income tax ⇒ income tax quick revision capsule by icai ⇒ income tax complete compact book ⇒ income tax chart book.

Learn about pctex with our data and independent analysis including nav, star rating, asset allocation, capital gains, and dividends. Start a 14-day free trial to morningstar premium to unlock our take on pctex.

Amendments finance act, 2020 (to the extent notified) circulars and notifications upto 31 october, 2020; questions 496 solved lllustrations (414 gst+82 customs/ftp) ca final past exam ques.

Vdi indirect tax laws summary cum compiler by vineet sodhani and deepshikha sodhanifor ca final may 2020 exam at onlinebooksstore.

Ca final direct tax dt summary for may 2020 exams compact comprehensive book updated as per finance act no 2 2019 by ca aarish khan aj next mumbai - students final.

Learn about three examples of how indirect taxes are imposed on products and included in costs to customers. Kate_sept2004/getty images an indirect tax is a tax that is paid through another party and then by the taxpayer.

Guys from here you can download the indirect tax case summary notes. Just click on the link below to download the notes download the idt summary notes zeroinfy is india’s largest online platform for exam preparation, with over 200+ hd quality video courses, 25+ best professors, currently covering exams like ca, cs, cma, upsc cse, iit-jee.

View ca vineet sodhani's profile on linkedin, the world's largest professional community.

Post Your Comments: