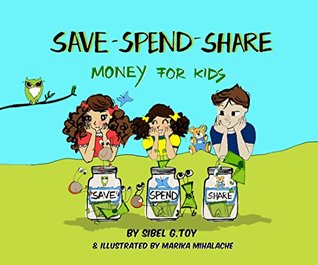

Read Save-Spend-Share, Money For Kids: Money For Kids - Sibel Toy file in PDF

Related searches:

One of the most comprehensive and engaging resources on the market is moneyisland™, a tropical island adventure by financial services company bancvue® that teaches children four basic tenents of personal finance: how to save, spend, share and invest.

It takes time to develop a habit of sharing money, but just like the other uses of money, the decisions made are based on values. Using money to help others can warm our hearts and strengthen our decision-making skills. Read the other articles in this series on saving, spending and investing money to help you talk about money topics with kids.

Give it a try! and let them see you spending and saving real dollar bills and coins so they begin to get a real, hands-on understanding.

These activities put the “fun” in money fundamentals! use them to help your children learn about the three important choices kids (and parents) have to make when it comes to money: sharing, saving and spending. Activity 1: coloring my “share, save, spend” pig (page 2) • have your kids color the picture of the piggy bank.

Label each bank with the way you ll use the money: save, spend, invest, and give� a spending bank for money to be used soon on everyday things.

Here are 7 tips to help kids learn about money from premier source federal these days many parents are finding themselves reevaluating the ways that they spend and save.

Try this save, spend, give and invest jar system to teach your kids money concepts.

Piggybot is a fun, easy way to track allowance spending and saving. The only parent-designed, kid-tested allowance app that helps kids spend, share, and save.

For years, money gurus have asserted that, with help from parents, kids use separate spend, save and give banks with their money.

What makes it unique: if your child is worried about siblings “borrowing” money, this piggy bank is the obvious choice. Instead of a plug, children create their own numerical password to keep their money secure.

Nov 13, 2013 automatically setting aside money for spending and charitable giving before you consider famzoo average spend/save/give allocations.

Moving is a major challenge, and it always seems to be more expensive than you expect. You need to find a new place, pay a deposit or down payment, and then arrange for an ongoing rent or mortgage payment.

Wondering whether you should give your kids an allowance or not? it's a wonderful way to teach your kids about money! we split kid's allowances into three.

Piggy bank learning tool, useful gift for kids, save spend share, money bank, budget tool, money management, learning activity, homeschool wheelsimplemoney 5 out of 5 stars (25).

Secrets to spending much less, from our financial guru, carmen wong ulrich. We may earn commission from links on this page, but we only recommend products we back.

Even if you absolutely love to cook, it would be great to save a bit of time here and there in the kitchen. Not only does it free you up to do other fun things, but it gets you seated at the table for meals much faster.

Saving money can be exciting when it is a relevant goal for youth. Making their own decisions about how to use their money is an important life skill. Read the other articles in this series on spending, sharing and investing money to help you talk about money topics with kids.

My husband and i had to get creative to save money for our four-person, single-income family. We may earn commission from links on this page, but we only recommend products we back.

It's never too early or late to teach your kids how to handle their finances. These apps will help them learn how to spend, save, and share.

9inch can only save the piggy bank save spend share money jar three-part money tin teaches kids financial.

Set up three jars for your child: one for saving money, one for spending money, and one for sharing.

Oct 11, 2012 - imom's share, save, spend tool is a fun way for kids to get in the habit of using their money wisely. Oct 11, 2012 - imom's share, save, spend tool is a fun way for kids to get in the habit of using their money wisely.

Demonstrating a balance of spending, saving and sharing family income; using credit wisely; knowing and practicing consumer rights and responsibilities.

If your child gets any regular or sporadic income (allowance, gifts, babysitting, chores, lawn mowing), it’s important to start teaching them to break out the money between the following categories: save – spend – share because many people review their finances and make savings plans at the beginning of january, i will focus on save.

Sep 27, 2017 my husband and i decided that at our house, allowance would be used as a tool for understanding money.

For an upcoming good housekeeping article, please tell us the smart things you and your family do to save money we may earn commission from links on this page, but we only recommend products we back.

Moonjar classic moneybox (save, spend, share) this award-winning moonjar moneybox is divided into save, spend and share tins that allow kids to set practical goals with their money for each section. Each moonjar kit also comes with a family guide with simple budgeting ideas and a passbook so kids can track their progress.

Almost everyone loves to travel, but the cost can add up quickly, especially when you start adding flights. Airfare alone can cost more than your lodging, food and souvenirs combined.

Ramsey thinks that kids should be taught about money at a young age and i agree. One of the ways he recommends to do this is to have spend, save, give banks which kids can use to intentionally manage their money. Spend, save, give jars are easy to make and will teach your kids important lessons about money.

Your monthly electric bill may be eye-popping, but there are simple and cost-effective ways to lower energy costs.

The traditional spend, save and give jars or banks most money experts laud have earned their place at the financial management table. They establish the habits your kids will need once they can work with money more abstractly, and they address the realities of how people really need to work with funds.

Moonjar classic moneybox this bank is a great way for kids to learn about budgeting. Three individual chambers, labeled save, spend, and share, can be bound together with an included rubber band and then separated when it comes time spend, deposit, or donate the money. Of all of the banks on this list, this feels the most like a teaching tool.

Dec 14, 2020 turn a $7 kmart kids money box into the ultimate 'spend, save, give' money box with this easy kmart hack! a fun diy project to do with the kids.

Save, spend, share is a style of teaching money management skills to children. It involves dividing an allowance payment into three categories -- saving, spending and sharing. The save account teaches your child to put money away for future use or to pay themselves first.

There’s nothing like being outdoors and crafting a beautiful front or backyard. Making your home garden and lawn more attractive and lush is fun, but can be expensive without planning.

After touching lightly on the difference between bills, coins, and their values, she dives into money management and appreciation. The sweet illustrations and accessible language of the save, spend, share invites children to see themselves in the pages.

Teaching kids about money is more than just saving and spending, it's also you first need to determine if you can afford to give your child an allowance.

The easiest way to teaching children how to manage money wisely (before letting it manage them) is through the save, spend, and give method. Whether you give commission based on certain extra chores completed, or a weekly allowance, grab 3 jars per child.

Dec 8, 2020 instead of a single piggy bank, give kids a jar for saving, spending, and giving. These are the three main “buckets” of our personal financial.

My boys save money in a traditional piggy bank with one compartment. If you want a more visual way for children to keep track of their money during the year, buy a bank with multiple slots or make your own save, spend, share bank by labeling 3 jars.

Spend, save, share jars are such a cool way of teaching money skills to kids. But we prefer ‘share’, as we’re not giving our money away here. Rather we’re sharing our resources with those in need in our wider community.

Is clear enough that kids can see their money grow in it; offers a place where kids can write down their goal for the money in it, either on a printable or on the jar/bank itself – this could be a savings goal, or a spend save give ratio/percentage; is easy for kids to get their money back out, so that they can spend it/use it on what they.

If you're a budget traveler or a frequent flyer, you know the value of research when putting together travel plans. You sign up for price alerts, check rates at multiple websites and adjust travel plans to get the best deals.

Every transaction can be a chance to teach life lessons about money to your children. To that end, an allowance presents an opportunity to explain the save, spend, share concept.

If you don’t have anything saved for emergencies, when something comes up like an unforeseen medical expense or a car repair, you’ll be left with added debt that can spiral out of cont.

Post Your Comments: